Your Chances of being harassed or sued are enormous.

"Anyone who owns property is an excellent candidate for a lawsuit. In any measurement of potential liability, we would rank the property owner at the top of the

list."

- Robert J. Mintz, Esq.

Chances of an individual being sued in America in a year/lifetime

Median Litigation Cost of ONE Real Property Lawsuit 2013

Fees Charged by Attorneys for 16,000,000 Civil State Court Lawsuits filed in 2002

Our Goal At TMS Is For You To Be Able To Sleep At Night.

That's Really It.

We are Trustees for Private Investment Trusts -- including Equity, Debt, Arbitrage

and Family Offices

We provide Nominee Trustee Services for all Delaware Statutory Trusts and other trusts nationally.

We can provide Nominee and Protector Trustees for Asset Protection & Family Offices.

We serve as Trustees for Private Equity Funds, including Debt, Equity, Arbitrage & Family Offices.

We provide all Trustee Services for Real Estate Trusts including 1031 and EB-5 entities, among others.

Do I really need this level of asset protection? Check out this free book by Robert J. Mintz, Esq. for an eye-opening read! - Download a complimentary copy of the book.

Just pick a Name for your Trust, pay your initial yearly fee and TMS prepares and files your "Certificate of Trust" within 1 Business Day.

"The

features of a Delaware statutory trust read like a holiday wish list

for planners: liability protection for the trustee; asset protection for

the beneficial owner; delegation of management; one-time registration;

no need for annual meetings; no franchise tax; no limit on the number of

investors; availability of indemnification; recognition of separate

series; and a favorable, if restrictive, published ruling approving its

use in tax-deferred exchanges of real estate. Depending on the context, a

Delaware statutory trust can be outfitted as a corporation or

partnership for tax purposes, or designed not to be a business entity at

all, where instead the beneficial owners' interests are treated as

grantor trusts."

--Charles J. Durante

Ten Benefits of a Delaware Statutory Trust:

1. Economical one-time registration fee with series trusts available, with excellent privacy in a longtime business friendly state.

2. Use as a top

level, statutorily protected holder of interests in other assets. Personal liabilities of the beneficiary cannot pierce the Trust.

3. Take Advantage of IRS resident, homeownership deductions

unavailable through an LLC ownership entity.

4. State of the art, preferred ownership Entity over Tenant in Common (TIC) ownership for 1031 exchanges. Not limited to 35 investors. Full tax benefits,

favorable financing (off title, non-recourse), no annual corporate fees.

5. Perfect for Private Equity and Family Office ownership.

6. Able to use Protector Trustees, Managers and Nominee Trustees to achieve both personal and business goals.

7. Complete, statutorily guaranteed, asset protection within a pass-through entity. No double

taxation issues.

8. May be a partnership, a corporation, an association or nothing at all for management and tax purposes

– but still with all asset protection benefits of a separate corporate entity.

9. A duly passed statutory law, not a personal contract or common law entity eliminates legal uncertainties over

personal liability or adversarial control over the trust corpus.

10. The ability for any person, including beneficiaries, to exercise control and manage the trust through the trustees, managers. etc. (as

in a grantor trust) without endangering the trust corpus.

Select the plan that is customized to your needs!

* NO plans include State Filing Fees ($500 per DST) or additional Expedited State Filing Fees ($50+)

** FREE. Just pay $9 S&H

Ideal for Family Asset Protection and/or Small Real Estate Holdings Under $5M Assets

Order Now** All plans must be paid in full for the first year. Beginning thereafter, plans may be paid monthly or discounted annually if paid in full.

Ideal for Securities, 1031 Exchanges, Active Business or Larger Asset Classes over $5M

** All plans must be paid in full for the first year. Beginning thereafter, plans may be paid monthly or discounted annually if paid in full.

Ideal for Family Offices, Asset Holdings over $10M or Complex Investment Classes

Order Now** All plans must be paid in full for the first year. Beginning thereafter, plans may be paid monthly or discounted annually if paid in full.

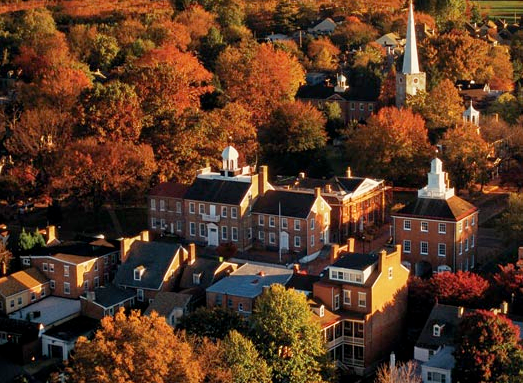

Founded in 1724, Jessop's is the Oldest pub in the U.S. outside of New York City

302.351.4928

info@detrustee.com

122 Delaware Street

2nd Floor

New Castle, Delaware 19720

1201 N. Orange Street

Suite 7535

Wilmington, Delaware 19801